Category: Deadlines

-

When Is Tax Due on Series EE Savings Bonds?

You may have Series EE savings bonds that were bought many years ago. Perhaps you store them in a file cabinet or safe deposit box and rarely think about them. You may wonder how the interest you earn on EE bonds is taxed. And if they reach final maturity, you may need to take action…

-

2019 Q4 Tax Calendar: Key Deadlines for Businesses and Other Employers

Here are some of the key tax-related deadlines affecting businesses and other employers during the fourth quarter of 2019. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. Contact us to ensure you’re meeting all applicable deadlines and to learn more about the filing requirements. October…

-

2019 Q3 Tax Calendar: Key Deadlines for Businesses and Other Employers

Here are some of the key tax-related deadlines affecting businesses and other employers during the third quarter of 2019. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. Contact us to ensure you’re meeting all applicable deadlines and to learn more about the filing requirements. July…

-

Still Working After Age 70½? You May Not Have to Begin 401(k) Withdrawals

If you participate in a qualified retirement plan, such as a 401(k), you must generally begin taking required withdrawals from the plan no later than April 1 of the year after which you turn age 70½. However, there’s an exception that applies to certain plan participants who are still working for the entire year in…

-

Beware the Ides of March — If You Own a Pass-through Entity

Shakespeare’s words don’t apply just to Julius Caesar; they also apply to calendar-year partnerships, S corporations and limited liability companies (LLCs) treated as partnerships or S corporations for tax purposes. Why? The Ides of March, more commonly known as March 15, is the federal income tax filing deadline for these “pass-through” entities. Not-so-ancient history Until…

-

2019 Q1 Tax Calendar: Key Deadlines for Businesses and Other Employers

Here are some of the key tax-related deadlines affecting businesses and other employers during the first quarter of 2019. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. Contact us to ensure you’re meeting all applicable deadlines and to learn more about the filing requirements. January…

-

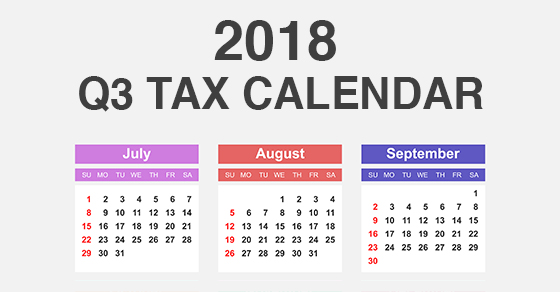

2018 Q3 Tax Calendar: Key Deadlines for Businesses and Other Employers

Here are some of the key tax-related deadlines affecting businesses and other employers during the third quarter of 2018. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. Contact us to ensure you’re meeting all applicable deadlines and to learn more about the filing requirements. July…

-

Tax Document Retention Guidelines for Small Businesses

You may have breathed a sigh of relief after filing your 2017 income tax return (or requesting an extension). But if your office is strewn with reams of paper consisting of years’ worth of tax returns, receipts, canceled checks and other financial records (or your computer desktop is filled with a multitude of digital tax-related…

-

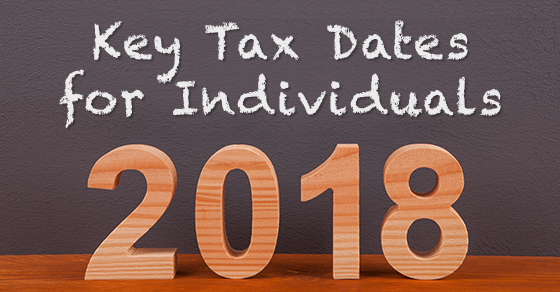

Individual Tax Calendar: Important Deadlines for the Remainder of 2018

While April 15 (April 17 this year) is the main tax deadline on most individual taxpayers’ minds, you also need to be aware of others through the rest of the year. To help you make sure you don’t miss any important 2018 deadlines, here’s a look at when some key tax-related forms, payments and other…